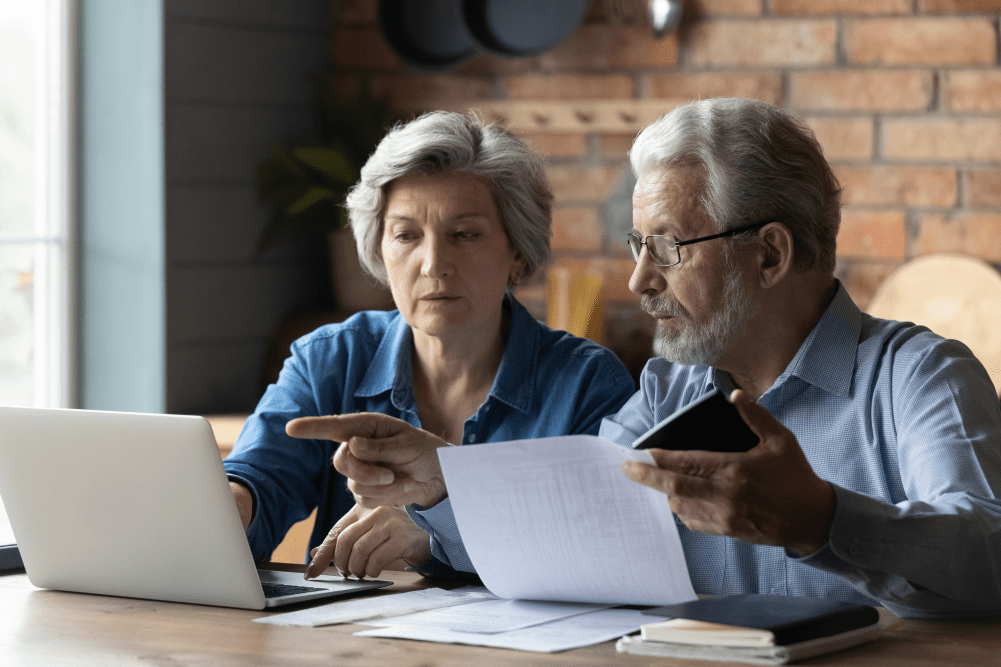

Australians are losing more money to investment scams

Australians are being urged to be extra diligent when it comes to investment opportunities that look too good to be true. According to Scamwatch, Australians lost over $205 million to scams between 1 January and 1 May this year – a 166 per cent increase compared to the same period last year. Investment scams on … Read more